If you’re planning to sell your property in Cyprus this year, there’s one crucial detail you can’t afford to overlook — taxes in Cyprus can quietly chip away at your hard-earned profit.

Before you sign anything at the Land Registry or celebrate with your estate agent, make sure you understand how Capital Gains Tax (CGT) works — and what steps you can take to reduce it legally.

Whether you’re an expat cashing in, a longtime resident selling your family home, or an overseas investor moving on, this guide will walk you through everything you need to know about Capital Gains Tax and other property-related taxes in Cyprus in 2025 — in plain English.

Capital Gains Tax is a government levy on the profit (or “gain”) made when selling immovable property in Cyprus. It’s one of the key taxes in Cyprus that property owners need to understand — especially if you want to avoid a shockingly high tax bill later on.

It applies when you sell:

A house or apartment

Land or building plots

Shares in companies that directly own property in Cyprus

The rate is a flat 20% on your net gain. But this isn’t on the entire selling price. It’s calculated after allowances, indexation (to adjust for inflation), and deductible costs.

The smarter your planning, the less you may owe. In some cases, you may even pay zero CGT.

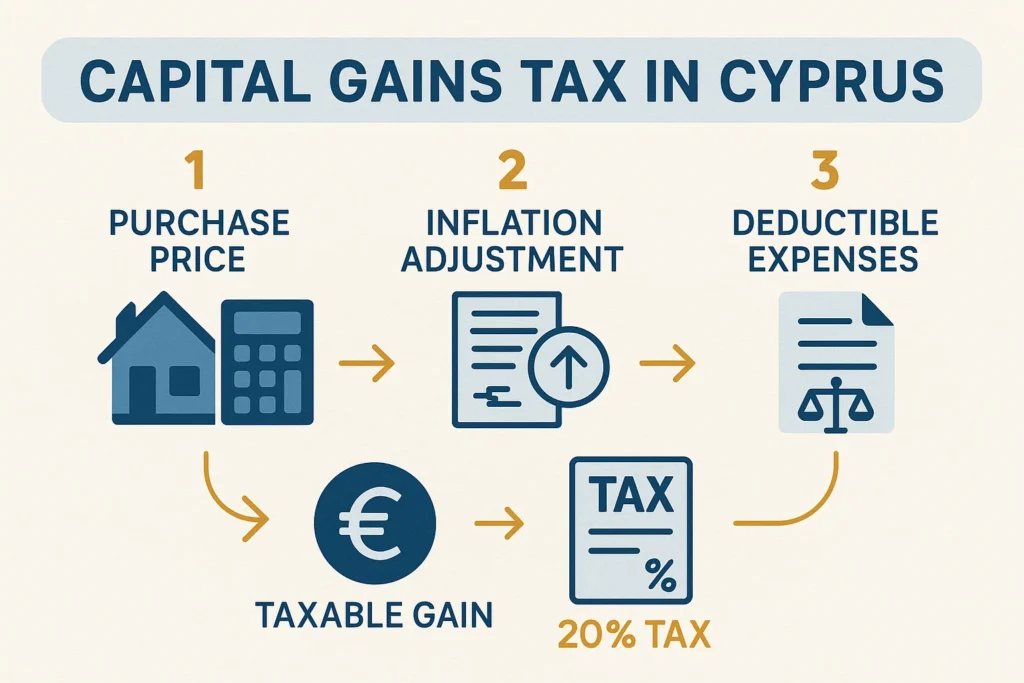

Let’s break down how Cyprus calculates your CGT bill — because knowing the formula means you can influence the outcome.

Step 1: Selling Price

This is the final amount stated in your sale agreement.

Step 2: Purchase Price

What you paid when you originally bought the property. This is your “base cost.”

Step 3: Inflation Adjustment (Indexation)

The Tax Department lets you adjust your original cost using inflation data — meaning long-term owners are rewarded for holding onto their property.

Step 4: Subtract Allowable Expenses

Legal costs, transfer fees, capital improvements, and estate agent commissions can be deducted — more on these next.

Step 5: Apply the 20% CGT Rate

Only after all those subtractions is the 20% rate applied — to your taxable gain, not your full sale amount.

You can confirm the original purchase price and transfer fees via a Search Certificate from the Land Registry.

Cyprus is surprisingly generous in allowing deductions — as long as they’re real, documented, and directly linked to the sale or ownership.

Here’s what qualifies under taxes in Cyprus law:

Legal Fees: Any legal services related to buying or selling the property can reduce your gain

Land Registry Transfer Fees: Paid when you first acquired the property? Deductible

Major Renovations or Structural Improvements: New kitchen, roof replacement, building extensions, or a swimming pool. Routine maintenance and decoration don’t qualify

Estate Agent Commission: Used a registered real estate agent? Their commission — with proper invoice — is fully deductible

Important: You need original invoices or official receipts for every deduction. No paperwork means no tax relief.

This is where taxes in Cyprus get a bit friendlier — there are several lifetime and conditional exemptions that can reduce or eliminate CGT.

Private Residence Exemption – up to €85,430

If the property has been your main home for at least 5 continuous years, you could claim up to €85,430 of your gain as exempt.

Proof required includes:

Electricity or water bills in your name

Cyprus bank statements

Local council tax records

General Lifetime Exemption – €17,086

This one-off personal exemption applies to any Cyprus property. You can only use it once, so plan accordingly.

Agricultural Land Exemption – €25,629

If you’re a registered farmer and meet the criteria, you can use this exemption when selling farmland.

Family Transfers

Property transferred between spouses or parents and children is fully exempt from CGT.

Donations

Gifting property to the State, local authorities, or registered charities is CGT-free.

Special Window Exemption

If you bought your property between 16 July 2015 and 31 December 2016, you may be completely exempt from CGT regardless of the profit.

Keep Every Relevant Document

You’ll need:

Original purchase agreement

Receipts for transfer fees

Contractor invoices

Utility bills if claiming the private residence exemption

Estate agent commission invoices

Request a Search Certificate

From the Land Registry — this confirms your purchase price, title history, and any relevant fees.

Use Your Exemptions Strategically

Don’t use your €17k general exemption on a minor deal if you’re planning a bigger sale in the future. Plan your sales timeline.

Time Your Sale

Selling after 5 years of residence unlocks the €85k exemption. If you’re close to that threshold, consider waiting.

Get Professional Advice

Especially if:

You’ve inherited or gifted the property

The title is shared

The property is owned through a company

You’re a non-resident or dual tax resident

While CGT gets most of the attention, it’s only part of the property tax picture in Cyprus. Other taxes sellers (and buyers) should be aware of:

Transfer Fees

Charged by the Land Registry when the title changes hands. Usually paid by the buyer, but important to factor in.

Stamp Duty

Applies when signing the sale agreement. This is generally the buyer’s responsibility but can affect negotiations.

VAT

This usually applies only to new builds or off-plan purchases. For resale homes, it’s typically not charged. However, check if your property still falls within the VAT period.

If you’re selling a new property still within the VAT period, consult your accountant. VAT and CGT can overlap in complex ways.

If you’re selling property in Cyprus in 2025, Capital Gains Tax is real — but it doesn’t have to drain your profit.

You’ll pay 20% on your gain, but you can:

Deduct legal, agent, and renovation costs

Adjust your purchase price for inflation

Apply exemptions (private residence, general, agriculture, etc.)

Structure the sale wisely with legal support

Keep great records to support every claim

Knowing how taxes in Cyprus work — especially when it comes to property — gives you the power to make better financial decisions. When your sale completes, you’ll be glad you took the time to prepare.

1. I don’t live in Cyprus — do I still pay CGT?

Yes. Capital Gains Tax applies to property located in Cyprus, regardless of your residency.

2. What happens if I can’t find my renovation receipts?

Undocumented work usually isn’t deductible. You need valid receipts to claim any expenses.

3. Can I transfer my property to my child without paying tax?

Yes — transfers between close family members (spouses, parents to children) are exempt from CGT under Cyprus law.

4. I bought my property in 2016 — do I qualify for the full exemption?

If the purchase was between 16 July 2015 and 31 December 2016, you may qualify for full CGT exemption. Confirm with your lawyer.

5. How do I know if I’ve used my €17,086 exemption before?

Your tax advisor or the Tax Department can check and confirm whether you’ve used your general lifetime exemption previously.